The first day of the new year 2022 became decisive for entrepreneurs. It was on January 1 that changes to the Law of Ukraine No. 265/95-VR "On the use of registrars of settlement operations in the sphere of trade, catering and services" came into effect. This means that all FOPs of the second-fourth groups (on the simplified and general taxation system) are obliged to introduce the use of PRO. It is more simply called a cash register.

In October 2019, Volodymyr Zelenskyy signed the corresponding order, which caused a flurry of protests by FOPs. Business representatives achieved the fact that a year later a draft law was approved to postpone the introduction until January 1 of this year.

In December 2021, a meeting of the Verkhovna Rada was held, in which another postponement was supposed to be considered, but the issue could not be included in the agenda due to a lack of votes. Despite the demonstration under the walls, which took place during the meeting, the date of entry into force of the law could not be postponed.

The only relaxation for FOPs was that on December 23, 2021, the Cabinet of Ministers exempted some categories of entrepreneurs engaged in retail trade in the village from the obligation to use PRO.

The cost of a cash register can reach 20,000 hryvnias, but the problem is solved by software RPOs, which we will talk about today. They are provided both for free and for a fee - it all depends on the specific service.

What is PRO?

РРО stands for registrar of settlement operations. This is a device that entrepreneurs are required to use when selling goods or providing paid services. As you can guess from the name, it registers settlement operations, transferring data to the tax service, and issues a fiscal check as confirmation.

Who needs and who doesn't need to implement cash registers

From 2022, almost all representatives of the trade, service provision or performance of works were included in the list of entrepreneurs obliged to use cash registers - real or virtual. This is called "total fiscalization", because until now the list of FOPs that must have a PRO was much smaller.

As stated in the law, business entities that carry out activities in the field of trade, public catering, provision of services and money transfer have to establish registrars. It does not matter how the payments are received - in cash or by card, checks, tokens, cash on delivery sent by the postal operator, etc. Also, the volume of sold goods or services is not important.

Everyone, including any shops, jewelry stores, restaurants and coffee shops, courier services, online stores, pharmacies and private hospitals, sellers of excise goods (alcohol, cigarettes), etc., are now required to install a PRO.

The list also includes FOPs that are exempt from installing registrars (mostly this applies to rural areas).

The following are not required to install PRO:

FOP of the first group on the single tax;

Organizations that receive funds using bank details;

Entrepreneurs who sell goods at retail in villages, if at the same time they do not sell excise goods and do not engage in online trading;

Catering establishments at educational institutions (schools, colleges, universities);

Realizers of goods from mobile points — tanks, barrels, hand-carrying items, tables, etc.;

Other cases from the list, which can be fully read in the explanatory document from the DPS.

What is software RPO? Differences between a cash register and a software cash register

Software RPO is a program, application or service that is installed on available electronic gadgets and simulates the operation of a cash register. It is much cheaper than a classic cash register, does not require the purchase of additional equipment, is registered very quickly and is easy to operate.

Cash registers began their history in 1883 and until now were concrete mechanisms that performed a settlement operation and printed a check for issuing to the customer. The mass adoption of software recorders is a global change in the field of entrepreneurship, which can be compared to the invention of the refrigerator or container shipping. These services allow small businesses to come out of the shadows, and the authorities to bring order to the small business sector.

Time will tell what the results of this innovation will be.

How to work with PRO

Let's first understand the principle of operation of settlement registrars. Both software and hardware RPOs perform the same function — they register the settlement transaction in the tax office, that is, the fact of transferring money to the client for the goods or services received. The procedure takes place in three steps:

PRO creates a check and sends it to the fiscal server of the State Tax Service of Ukraine;

The server assigns it a number and sends it back;

The check can be issued to the buyer in printed form or sent in an electronic version.

Anyone can check a check issued with the help of PRO on the website of the DPS of Ukraine.

If for some reason there is no connection with the DPS server, the registrar has a reserve of 2,000 numbers, which it independently assigns to checks. After the connection is restored, the data about the performed operations are sent to the server all together.

Read also: Marketplaces - how to sell goods without having your own online store

How to choose the type of PRRO

There are several types of software recorders, which differ mostly in location:

Stationary is installed at a certain address and is used for retail sales points or in institutions that provide services without going to the object.

Mobile can be registered to a mobile economic unit (car) and is used throughout the country. Such a device can be registered, for example, for a mobile coffee shop.

The service counter is the same stationary PRO, which does not involve the involvement of the seller, the buyer can make the calculation independently. Such cash registers can be installed in supermarkets.

The registrar for Internet trade is used at the address specified in the registration application and is intended for conducting operations for online purchases from the sites.

On which devices is PRO installed

Software PPO can be installed on any gadget that has access to the network and an operating system, including Android. These are smartphones, tablets, laptops, desktop computers.

How to get a check

The settlement check can be received electronically by post or messenger, in the form of a QR code, or printed, if a check printer is available.

Work in offline mode

The PRRO provides an opportunity to work offline if there is temporarily no access to the Internet or there is no connection between the entrepreneur's device and the fiscal server.

Offline mode can last a maximum of 36 hours in a single session or 168 hours cumulatively over a month.

The period of offline work begins and ends with a corresponding message, during this period fiscal checks should not be registered on the tax server. You do not need to submit these applications manually, everything happens automatically. The registrar automatically switches to offline mode and back again if there is no contact with the fiscal server.

A check issued offline contains a corresponding mark.

Barcode scanner

Many entrepreneurs have a question - is it possible to connect a barcode scanner? There is such an option, you can connect the scanner to the device via a USB port or Bluetooth.

Do you need to print receipts?

In this matter, entrepreneurs are free to choose - you can connect a printer for checks to a device with a software recorder and print them, but it is also allowed to form, store and send electronic checks to customers. Both methods are equally legal.

Penalties for violation of the rules of use or lack of PRO

The absence or incorrect use of the PRO entails the imposition of financial sanctions (taking into account the fact that the tax-free minimum is 17 hryvnias):

20 tax-free minimums — in case of violation of the procedure for registration and issuance of settlement documents through cash registers;

30 non-taxable minimums — for failure to submit to the tax office reporting documents related to the use of PRO, lack of a control tape (electronic or printed) or distortion of data in it;

50 tax-free minimums — for the absence of PRO or the use of unregistered cash registers.

300 tax-free minimums — for making calculations without entering the name of the product, its quantity and value into the program.

If an entrepreneur sells part of the goods or services without taxation, he faces a fine, which depends on the amount of funds received.

The first time you will have to pay the full price of the goods or services sold, in case of further violations the fine is 150% of the check.

By the way, until the beginning of 2021, the fines were smaller - 10% for the first violation and 50% for subsequent ones.

Such a significant increase in the amount of "punishment" encourages entrepreneurs to massively install software PRO — it's easier, cheaper and allows you to comply with the law.

Software PRO services

Let's take a look at the services implemented by the software PRO. These are both paid and free developments that are most often used by business representatives in Ukraine.

Read also: Overview of payment systems: Interkassa, LiqPay, EasyPay, Portmone, Fondy, WayForPay .

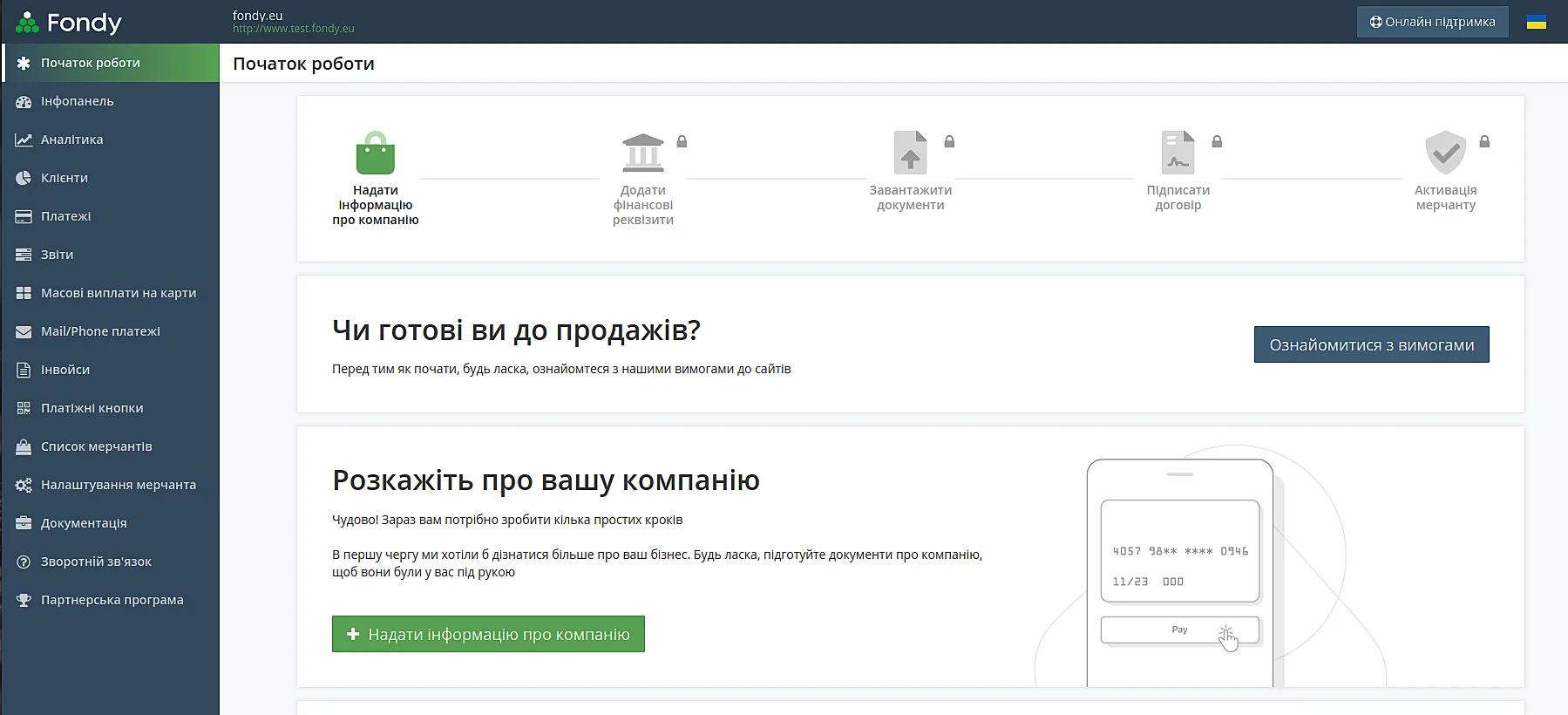

Fondy

Fondy's paid cloud service offers a free solution for businesses. You don't even need to download the program — everything happens in the browser, the client works on the service through his account. But there is one nuance — the service is available only to customers who accept payment through Fondy. There are no charges for connection and use, but there is a standard payment fee.

PRRO of this company allows you to quickly fiscalize sales and submit online reports to the tax service. The developer independently maintains the service, and the client only uses its tools.

Registration on the service is very simple - in addition to traditional filling out of the form, you can register in one click through Google, Facebook or Linkedin accounts.

One of the advantages is the integration of PRRO with other Fondy capabilities, including more than 60 plugins. The service allows you to make mass payments, create invoices for foreign clients, and create payment buttons using the designer. There are also various tools for monitoring financial events. Works with various cards and payment systems, including Apple Pay.

All operations are automated as much as possible, and reports are available in the control panel at any time.

"Sota kasa" and Cash?lot

These software products were created by the "Intellectual Service" group of companies - a large team of accounting specialists who have been creating software for electronic work with financial documents for 25 years.

"Sota kasa" and Cash?lot enable:

Register any number of cash registers and cashiers;

Automatically generate checks and reports, fiscalize calculations;

Send checks to customers in a convenient way - in messenger, by mail, by SMS;

Accept payment in any format - cash, card, credit, gift certificate.

"Sota kasa" is a cloud service that replaces the cash register. Available to individuals and legal entities, works on any device. It does not need to be installed on a specific gadget - you can access your account from any browser by simply entering your login and password on the site.

The cost of the service is formed individually, depending on the set of selected options. The client makes up his tariff as a designer, marking the selected tools with checkboxes.

So, "Sota reporting" costs 442 hryvnias per year for individuals and 2,002 hryvnias for legal entities. There are modules "VAT accounting", "Excise tax accounting", "Electronic document management". You can buy all of them, or you can buy only one.

It is possible to order a qualified electronic signature (KEP) for a symbolic amount of a few hryvnias. The KEP comes with a mandatory application — the "Varta" software complex for cryptographic encryption.

Pricing is very flexible, so after forming his package, the client can receive a check for the amount of approximately 400 to 7,500 hryvnias.

Cash?lot is a program that is installed on a computer. If we compare the two products, the cloud-based "Sota cash register" depends on an Internet connection, while Cash?lot can work autonomously for a maximum of 36 consecutive hours, saving data on the entrepreneur's device.

Software is purchased for a certain number of cash registers, the cost depends on the form of registration of business activity. For example, a program for 3 cash registers for a legal entity will cost 4,290 hryvnias.

Unfortunately, these products do not have the ability to test the service, as there is no free trial period.

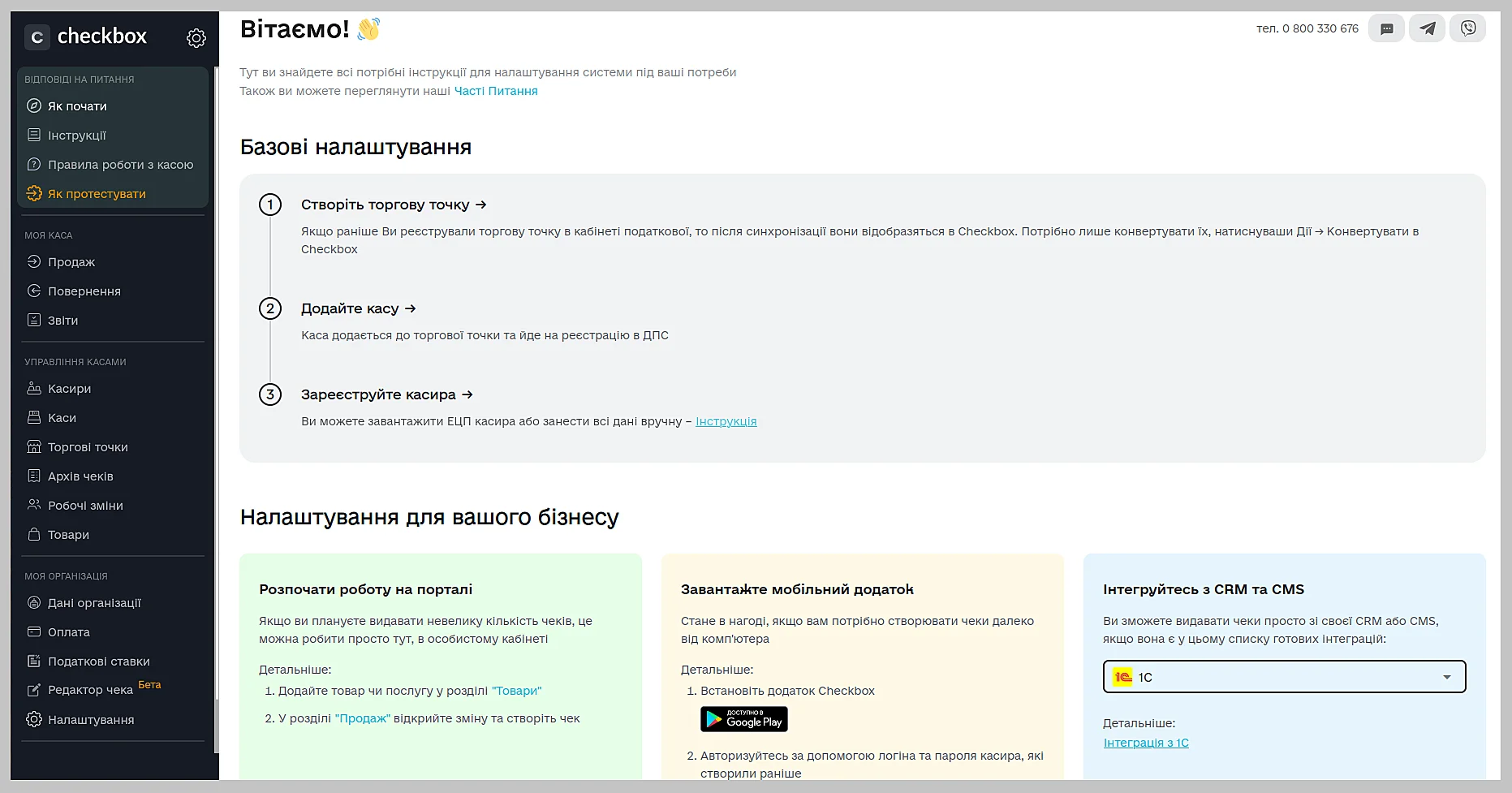

Checkbox

The Checkbox cash register completed beta testing in October 2020 and began its work. Customers can get the product with free installation for a month of testing. After the trial period, the service will cost 149 hryvnias per checkout per month.

The service is designed for three categories of users:

Small business;

Online stores and services;

Large retail chains.

One of the founders of the company is Dmytro Dubilet, also co-founder of Monobank. From this it can be concluded that Checkbox will have a similar level of service provision.

Service capabilities:

Automatic closing of changes and reminders about unclosed changes;

Adding cashiers, cash registers and sales points: upon registration, all data are automatically sent to the DPS, which eliminates the need to go to the tax office;

Forming a report from the selected cash register in any date range;

The convenient "Answers to questions" section, which helps to start working with the service, contains instructions and rules for working with the cash register;

On the site and in the client's control panel, important messages are highlighted - for example, if the DPS servers are unavailable and the approximate time they will be turned on.

The service works with partners who sell cash register equipment and offers options for purchasing the necessary devices (for example, a printer for printing receipts).

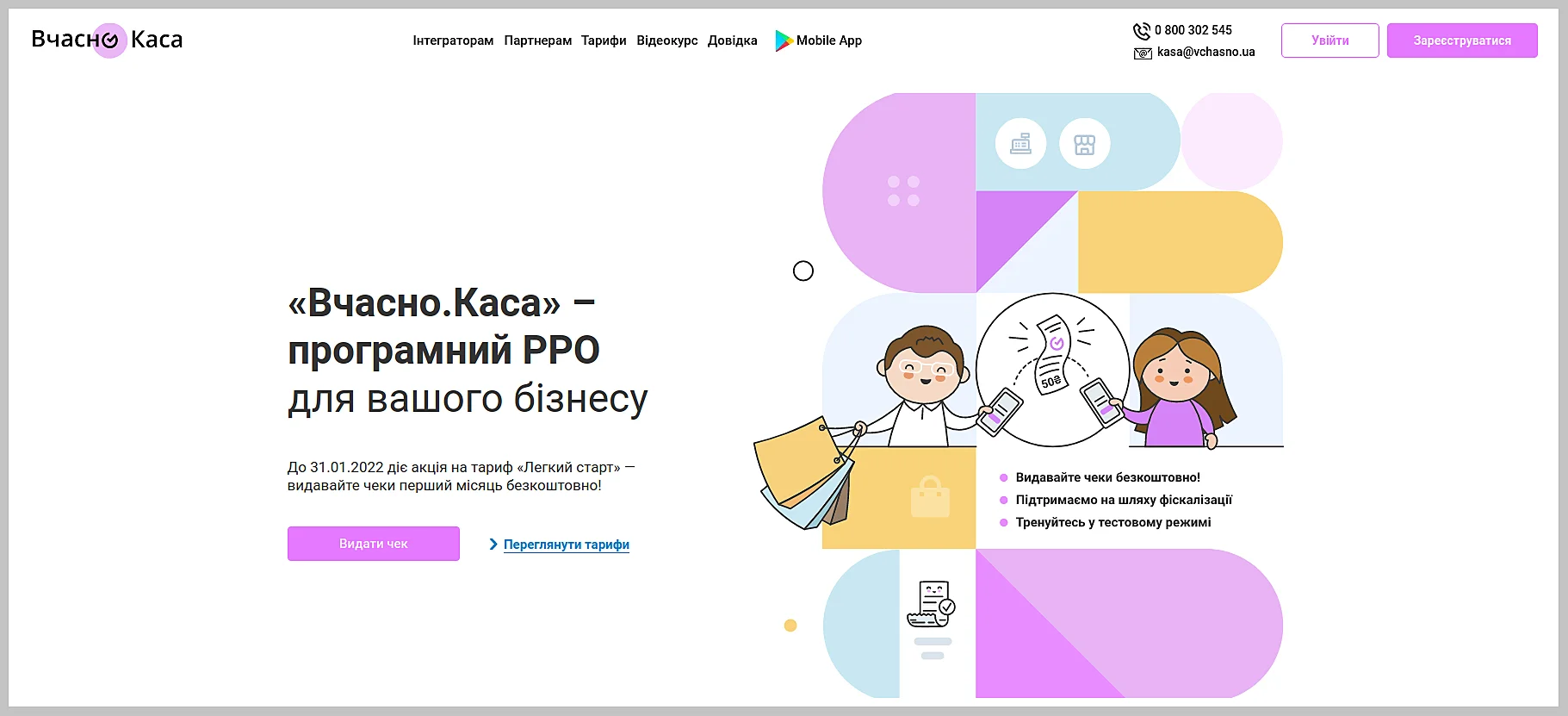

Checkout on time

You can work with the "Vchasno.Kasa" web service on a computer or tablet through the user account or install a mobile application.

These products enable:

Start a beginner entrepreneur;

Create an unlimited number of checks and send them to messengers or to the post office;

Integrate the service with the online store;

Work without internet.

The concept of the project consists not only in helping entrepreneurs with the fiscalization of operations, but also in their training. When you open the site, you will immediately be greeted by a video instruction on creating checks, and on the main page there is a link to an entire video course "All about cash registers and checks". There is a large section with tips and answers to common questions.

In general, the service is quite simple and is aimed at getting the FOPs to start using the PRRO in their work.

Customers can choose one of four tariffs - "Postal" up to 300 checks per month is provided free of charge. "Easy Start" costs one thousand hryvnias per year, at the time of writing the promotion is valid - the first month is free. "Business" and "Cash register integration" are already designed for larger enterprises and cost 1,800 and 1,699 hryvnias per year, respectively.

The user can choose any software registrar convenient for him — both among the popular ones described above and new ones that are undergoing a testing period. The main thing is that these services function normally and do not cause failures, because it is entrepreneurs who will be fined for errors in submitting reports and conducting operations.

Every year, the state comes closer to the implementation of all the necessary procedures that will contribute to the maximum legalization of small businesses. First, a simplified taxation system was developed, which allows registering FOPs for freelancers and other self-employed workers, now a new step is the transfer of all FOPs to making settlements with clients using PRO and PRRO.

Currently, the implementation of the Law is progressing slowly and with difficulty, and one of the reasons is the massive installation of software PROs, which makes service sites unable to withstand the load.

The founder of Checkbox, Dmytro Dubilet, made a public apology to the users of the service on his Facebook page — his clients felt the most unpleasant effect of the failure on the site.

Problems arose not only among those who installed the software, but also among entrepreneurs who have been using it for a long time. Some FOPs closed in January, hoping that the technical problems would be resolved or that the Verkhovna Rada would still cancel or at least postpone the implementation. In the meantime, the developers correct the shortcomings and are engaged in the expansion of hosting to increase the bandwidth of the services.

Currently, not all entrepreneurs have been able to install the PRRO and use it normally, so the Supreme Court decided not to collect fines from FOPs until the beginning of February.

Representatives of small and medium-sized businesses are divided into two camps — some are categorically against the introduction of settlement registrars for all business owners, while others support the reform and hope that everything will settle down soon.

The situation changes every day, so it will be possible to sum up after overcoming the zone of turbulence. In any case, software RPO is an extremely interesting and promising development that can forever change the history of small business.