Many IT specialists work on a freelance basis - software and game developers, testers, copywriters, designers, translators. For the full-fledged work of a professional, it is important not only to rent a server , create an advertising site or register on an exchange for freelancers. It is important to ensure that all activities are carried out within the framework of the law.

When IT-freelance first appeared, no one wanted to register a business. But today, more and more freelancers prefer to receive "white" earnings and become full-fledged tax payers.

Why and how to register a sole proprietorship in Ukraine in 2022? Let's figure it out.

What is a FOP and who can register it

FOP is a natural person-entrepreneur, a form of conducting business activities on behalf of a natural person. This is a simplified taxation system that allows you to work without registering the status of a legal entity. By analogy with the name of the system, such entrepreneurs are often called "simplifiers". The second name of the system is a single tax, which is why entrepreneurs are also called "single taxpayers".

An important advantage of the "simplification" is that the entrepreneur can independently submit reports and calculate his taxes without hiring an accountant. Many FOPs still outsource documentation to professional accountants, especially if they have employees, but this is mostly done to optimize their own workload.

Any citizen of Ukraine over the age of 18 and a foreigner with a residence permit and a work permit can register a business entity.

Many freelancers already have the status of an entrepreneur, but there are also those who still have doubts. So let's answer the following question.

Why register a FOP?

It would seem, why deal with all this red tape with registration, reporting, paying taxes? But an IT freelancer who has a good steady income has many reasons to register an FOP.

Loans and investments for business. For example, you decide to expand and create your own website development or copywriting studio. Initially, infusions will be needed — for renting an office, paying the first salaries to full-time employees, buying hosting , registering a domain , developing a website, and so on. Or you have an interesting startup for which you are looking for investors. It is possible to enter into any business relations only if the business is registered.

Certificate of income. There are situations when it is necessary to submit a certificate of income during the preparation of documents. Most often, this is the processing of a visa or a loan. For example, the USA can easily refuse a tourist visa if you have few ties to your homeland (no permanent job, family) and insufficient funds for the trip. Countries popular with migrant workers refuse visas whenever there is suspicion of illegal employment or attempts to emigrate. It's the same story with credit — if you're officially unemployed, your chances of getting a mortgage or other big credit are nil.

Customer trust. When working with freelancers, customers often prefer registered entrepreneurs. So they can document their cooperation and be able to defend their rights in case of dishonest work.

Ability to work with foreign customers. If you work through an exchange, you will be able to cooperate with foreign clients without a FOP. But the stock exchange is rather a starting point. Many freelancers eventually go beyond it and start communicating with customers directly. And here the status of an entrepreneur is required.

Work experience and pension. Those who have not officially worked or have a work experience of less than 15 years will receive payments in the amount of the minimum living wage. FOPs receive work experience and a pension depending on which EUV they paid.

A fine for running a business without registration is up to UAH 85,000.

For site owners, it is possible to buy an SSL certificate with company verification (OV), which provides more reliable protection of financial data of customers on the web resource.

Which group to choose

Groups II and III of simplified taxation are suitable for freelancers. Other groups are not suitable due to restrictions and specifics: in the I group, you can only trade in the market and provide household services to the population, IV is intended only for agricultural producers. So what are the working conditions for freelancers on the above two groups?

II group

Income no more than 834 minimum wages (5,421,000 UAH).

Ability to hire up to 10 employees.

Permitted types of activity — any services to the population or single tax payers (except those prohibited by the single tax ).

The tax rate is 20% of the minimum wage (1,300 UAH) and 22% of the minimum wage (1,430 UAH).

III group

Income no more than 1,167 minimum wages (7,585,500 UAH).

The ability to hire employees is unlimited.

Permitted types of activity are any services (except those prohibited by the single tax).

The tax rate is 5% of income and 22% of VAT (UAH 1,430).

The amounts we are talking about are relevant in December 2021, when the minimum salary is 6,500 hryvnias. Over time, they will change along with the growth of salaries.

EUV is a contribution to the pension fund, which forms the entrepreneur's pension in the future. The specified amount is the minimum allowable amount. You can contribute more - then the pension will be larger.

Which group to choose? A significant difference lies in the permitted types of activity. In the II group, services can be provided only to the population and single taxpayers. That is, the customer can no longer be an enterprise that pays taxes according to the general system or is not a resident of Ukraine. In the III group, you can work with everyone, including foreigners and legal entities. Since IT specialists often cooperate with foreign customers, they usually choose the III group. But if you provide services only to individuals and sole proprietorships in Ukraine, you can take the II group.

How to choose KVEDs for a freelancer

KVED is a classifier of types of economic activity. It specifies the work of an entrepreneur.

You can register several KVEDs at the same time - no one will scold you for not using one. But if your activity does not correspond to any of the KVEDs, then you can receive a fine. So it's better to play it safe here.

You can choose from the list of KVEDs in section J, which is responsible for information and telecommunications. Most often, IT freelancers are suitable for QUEDS from sections 62 (Computer programming, consulting and related activities) and 63 (Provision of information services).

Benefits of registration of a sole proprietorship for an employee

You can register a sole proprietorship not only for self-employment. Currently, it is a common practice in IT companies when a permanent employee does not work under an employment contract or employment book, but is registered as a self-employed person. Cooperation takes place according to the principle of customer-executor.

This form is beneficial to both parties.

Tax savings

Let's count. If a specialist works for hire, he pays 18% taxes and 1.5% military levy, and the employer gives 22% of his salary to the state for each employee. In general, payments from both sides amount to more than 40%. Let's take a salary, for example, 20,000 hryvnias. After deducting taxes from the employee, he is left with about 16,400. Plus, the company pays 4,400 in tax for him. As a result, the employee costs the company almost 25,000 per month, while receiving a little more than 16,000.

And now let's take as an example the FOP of the third group. It provides for the payment of 5% of income and social security in the amount of UAH 1,430. Five percent tax on income 20,000 — 1 thousand hryvnias. As a result, 17,500 is received. At the same time, the employer does not pay anything for cooperation with the specialist - he simply pays for the order.

The savings, as they say, are obvious.

More opportunities and freedom

The second benefit is greater freedom for both parties, but also greater responsibility. When an employee is hired, it is difficult to fire him, even if he does not cope with his duties - he is protected by the law. If he is registered as a FOP, you can simply stop giving him orders. This encourages employees to do their work well.

The IT specialist himself is also not tied to one employer. He can take orders from other customers and switch to another company at any time without paperwork. Such a situation motivates the employer not only to pay the order on time, but also to build positive relations with employees, trying to look advantageous against the background of competitors.

Start for the company

On the II and III groups, you can hire workers, and this allows you to expand. Today you work as a solo performer, tomorrow you already delegate part of the tasks to other specialists, and the day after tomorrow it is a serious business.

A flexible tax system allows you to move from one group to another, and when an entrepreneur no longer fits within the framework of a sole proprietorship, he can register an LLC.

How to register an FOP

Previously, it was possible to register a FOP only "with your feet" in the so-called TsNAPs, at a notary or special accredited objects of state registration. The process was long and complicated - this is another reason why entrepreneurs were in no hurry to pay taxes. The fact that registration and reporting can only be done at the place of residence made the procedure particularly difficult.

Currently, the procedure for opening a sole proprietorship in Ukraine has become much easier, as online registration is available. You also register at your place of residence, but you can conduct business anywhere and submit all reports electronically. Therefore, in fact, you can not come to your hometown at all, if you do not live there.

Before registration of the FOP, it is necessary to obtain an electronic digital signature (EDS). It is easiest to issue it through your bank, for example, get an EDS through PrivatBank .

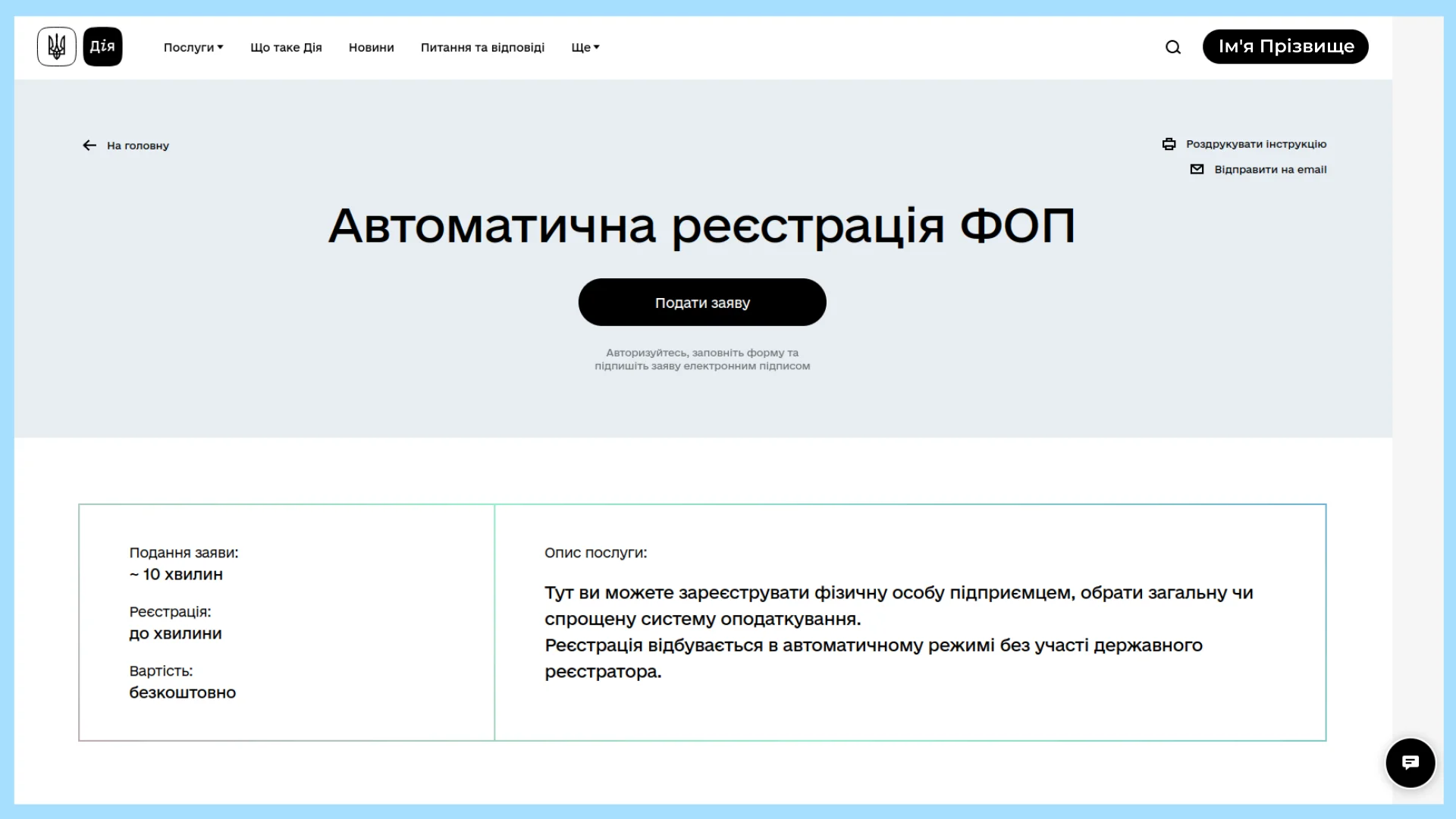

Then you need to create an account on the state portal "Diya" . Many already have accounts created under COVID certificates, rights or students. But if you don't have an account, it's very easy to register through BankID. You just need to go through authentication, such as for entering your account — and the system will pull all personal data from the bank, which can be edited if desired. There are other registration methods.

To issue an FOP, you need to find a section on the website:

Services ? Business ? Creation of a business ? Automatic registration of FOP

The process is as clear and simple as possible, you will receive confirmation of registration by e-mail. Users still have many questions and complaints about the "Actions" website and application - it periodically freezes and "bugs". But even in this form, it is more convenient to register a business through the portal than to stand in line and go around the instances in person.

You can pay taxes and submit reports through the taxpayer's electronic account on the website of the tax service.

At first glance, it may seem that it is difficult to issue and run a sole proprietorship on your own. But after understanding the system, you will see that there is nothing complicated about it. Simplified taxation was specially developed so that a taxi driver, a clothes seller at the market, and a freelance programmer could run their own small business.