With the beginning of a full-scale invasion, Ukrainian business froze — some entrepreneurs went to the front, others evacuated, many were simply too shocked to work. Someone closed the office and started volunteering, and in the war zone it became impossible to do business at all.

In mid-March, more than 40% of small businesses did not work, and only 13% continued their work on a full scale.

The Ukrainian economy is experiencing colossal losses not only due to physical destruction, but also due to a decrease in the activity of entrepreneurs. Therefore, the authorities call on everyone who can work in this difficult period to resume their activities in order to maintain an equally important economic front. As of the beginning of April, entrepreneurs are starting to resume work, markets, shops, the service sector, and the production of socially important goods are working again.

To support business, the state implements a number of measures that facilitate work and encourage entrepreneurs to operate. We will tell you how wartime business aid works and how to take advantage of it.

Tax reduction

Tax benefits in Ukraine during martial law were introduced on March 17, 2022 and are designed to reduce the burden on entrepreneurs as much as possible. Due to these relaxations, the state and local budgets will receive significantly less money, but now the main thing is for the business to survive.

For the third group of FOPs, the single tax rate has decreased from 5% to 2%, VAT is not required to be paid. The same tax rule is established for all entrepreneurs (FOP and legal entities) with a turnover of up to 10 billion hryvnias per year.

Read also: "How to register an FOP for IT freelancers and which group to choose."Self-employed persons and farms are allowed not to pay Social Security Contribution (SSC) for themselves. The rule is valid during the entire period of martial law and for one year after its termination. Also, it is not necessary to pay ESSV for mobilized workers to FOPs of the II and III groups. Non-profit organizations that do not make a profit during the war are also exempted from the payment of the EUV.

FOPs of groups I and II are exempted from mandatory payment of the single tax, but may pay it voluntarily.

Owners of assets located in the combat zone in the temporarily occupied territories are exempt from paying land tax and environmental tax until the end of the year following the year in which martial law is lifted. Rent is also not paid for land plots that are in state ownership.

The VAT rate on all types of fuel has decreased from 20% to 7%, the excise tax has been abolished.

All types of charitable assistance for the benefit of the Armed Forces, forcibly displaced persons and those in the war zone are not taxed.

Fines will not be imposed for violation of the rules of registration and work with the PRO until the end of martial law.

Read also: "PRO: what is it and who needs it, an overview of software PRO services."

The information may change and be updated, so we advise you to follow the news about tax benefits during the war on the website of the DPS of Ukraine .

Employment of displaced persons

For providing a workplace to an internally displaced person, the entrepreneur will receive 6,500 hryvnias within two months.

To receive a payment, you need to conclude a contract with the employee and register his data in "Diya" or in the local department of the State Employment Service.

We transport business

If your enterprise is in a danger zone, the state provides assistance with its relocation. An entrepreneur can get space and equipment for work, help in transporting employees and providing them with a place to live, etc. Workers will also be selected from among local residents to complete the staff to replace those who serve in the Armed Forces, have been evacuated, cannot work due to their health, etc.

The state gives preference to enterprises that produce socially important goods — food products, clothes, shoes, etc. But everyone who left a request will receive an answer to the application and help.

This option applies to both large enterprises and small businesses. You can submit an application for evacuation to the western regions via the link.

So far, about 90 enterprises have been transported to the west, more than half of them have already started working. The authorities have received more than a thousand applications for business relocation, which are now being actively processed.

By the way, Cityhost also carried out a partial relocation abroad (admittedly, independently). We have moved hosting and VDS servers to Germany, so our customers' data is more secure. Read about this and other steps to stabilize work in the news "Cityhost continues to work - changes in the realities of war".

Lending

The government provides an opportunity to get a loan of up to 60 million hryvnias at 0%. After the abolition of martial law, this benefit will be valid for another month, after which the rate will be 5%. The maximum credit term is up to 5 years.

Funds are provided for the purchase of basic equipment and raw materials, as well as for the replenishment of funds necessary to ensure the possibility of entrepreneurial activity.

Reduced requirements for loan recipients: any enterprise whose owners, shareholders and ultimate beneficiaries are Ukrainians can count on it. Citizens of the occupying country or members of terrorist organizations financed by it do not have this opportunity.

Lending will work on the basis of the program "Affordable loans 5-7-9%" and is available in Ukrainian banks.

Aid to the agricultural sector

Agricultural farms perform an extremely important mission, feeding not only Ukrainians, but also other countries, so the state has separately developed assistance programs for farmers. Since, due to the impossibility of exporting their goods abroad, agricultural enterprises do not have enough funds for the purchase of seed material, they can take a loan for the sowing campaign, the interest on which is compensated by the state. The loan amount can reach a maximum of 50 million hryvnias.

Also, for farmers, the procedure for certification of seed materials is maximally simplified, it is allowed to operate sowing machines without registration.

The Ministry of Agrarian Policy has created a questionnaire in which farm representatives can leave an application regarding their needs.

Private initiatives

In addition to state aid, our entrepreneurs can take advantage of initiatives from private companies, both Ukrainian and international. Their work is coordinated with the state and is aimed not only at financial support of business, but also at consulting, informing, finding opportunities, etc.

Assistance through production financing

The Ukrainian company "Economy of Trust" launched a program thanks to which local producers can receive funds for the production of goods intended for charitable purposes.

In this way, foreign benefactors do not just transfer money for volunteer needs, but spend it through Ukrainian entrepreneurs who can cover the costs of raw materials, energy supply, labor wages, etc.

For example, the enterprise produces shoes that can be handed over for the needs of forcibly displaced persons. You can submit an application for the production of a certain number of pairs of shoes, which the manufacturer undertakes to give to volunteers free of charge. After processing the application, he will receive the necessary funds in the form of a charitable contribution.

If you create a socially important product and want to join the campaign, fill out the form at the link .

Biz For Ukraine

Biz For Ukraine is a service for companies whose specialists can work remotely. The project was created by the Institute of Marketing (Estonia) together with the Office for the Development of Entrepreneurship and Export Promotion (Ukraine).

It can be used by enterprises that work in the following areas:

Design (clothing, magazine layout, illustrations).

Architecture, engineering, building design (heating, electricity, air conditioning and water supply systems).

Marketing (SEO, SMM, site analysis, integration with Google services, marketing strategy).

Consulting (jurisprudence, accounting and finance, export settlements, taxes, recruiting).

IT industry (development of software, sites, mobile applications, UI/UX design, development of Wordpress sites).

If you represent a company whose employees can provide services remotely, join the list of performers that customers will see, fill out this form.

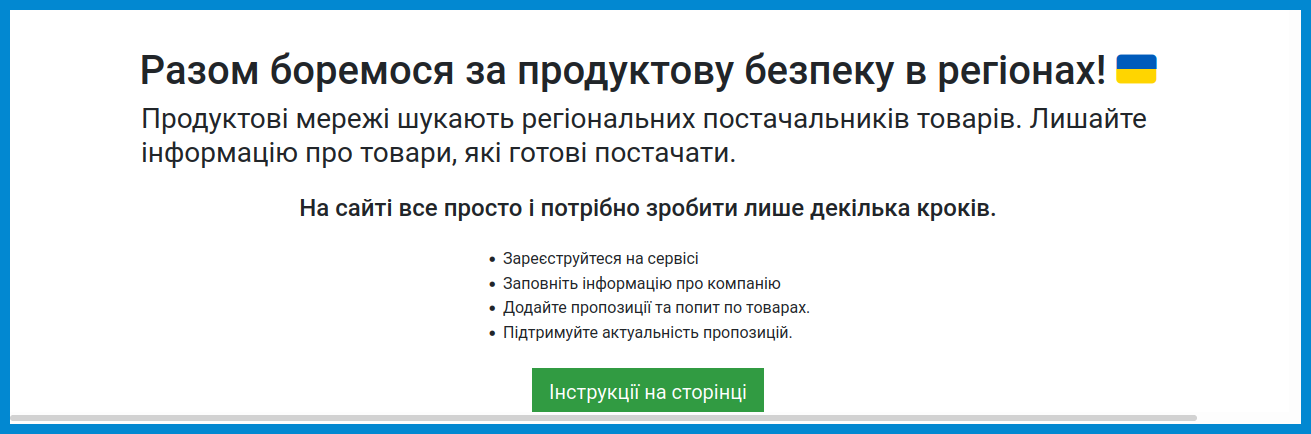

Product networks are looking for suppliers

Zernotorg.ua is a Ukrainian platform that helps large-scale grain enterprises and farms communicate. Together with the Ministry of Agricultural Policy, they developed the "Processing" service , where food manufacturers and trade networks can find each other. This is very useful at a time when established chains are broken and new contacts need to be sought.

If you are a manufacturer or a point of sale of products, fill out the form and find your partners.

EU4Business program

EU4Business is a program to help small and medium-sized businesses, created with co-financing from the EU and the German government. It is aimed at supporting business in six countries of the Eastern Partnership, among which is Ukraine (and there is no Russia).

The program itself has existed since 2016 and has already supported about 10,000 enterprises in their quest for development. In 2019-2021, the initiative helped businesses adapt to the realities of the coronavirus.

In March, a new program "Competitiveness and Internationalization of SMEs" was created, the main goals of which are to preserve jobs, employ displaced persons, help businesses refocus on relevant areas, and involve the diaspora in support.

Representatives of Ukrainian business and local communities who have specific requests and needs can send a letter to eu4business.ukraine@giz.de.

How the capital works

Some entrepreneurs have already started their work in front-line Kyiv - bakeries, shops, markets, pharmacies, gas stations. KMDA maximally contributes to the return of business and active life in the city. Transport has been restored where possible.

On March 30, KMDA introduced a number of benefits for local entrepreneurs. In particular, mobile trade enterprises, restaurants and enterprises that work on the communal square are exempted from paying rent (it will be 1 hryvnia). Advertising services that publish patriotic ads and parking lots will receive benefits.

A meeting of the Kyiv City Council at which benefits for entrepreneurs were introduced. Photo from the Official portal of Kyiv.

In order to support entrepreneurs in their specific needs, a special online platform has been created in Kyiv and the region, where business representatives can leave a request for assistance needed to restore or continue work. Questionnaire at the link .

If you are a Kyiv entrepreneur working during the war, add yourself to the map of working enterprises . The map itself can be seen in the Kyiv Digital application.

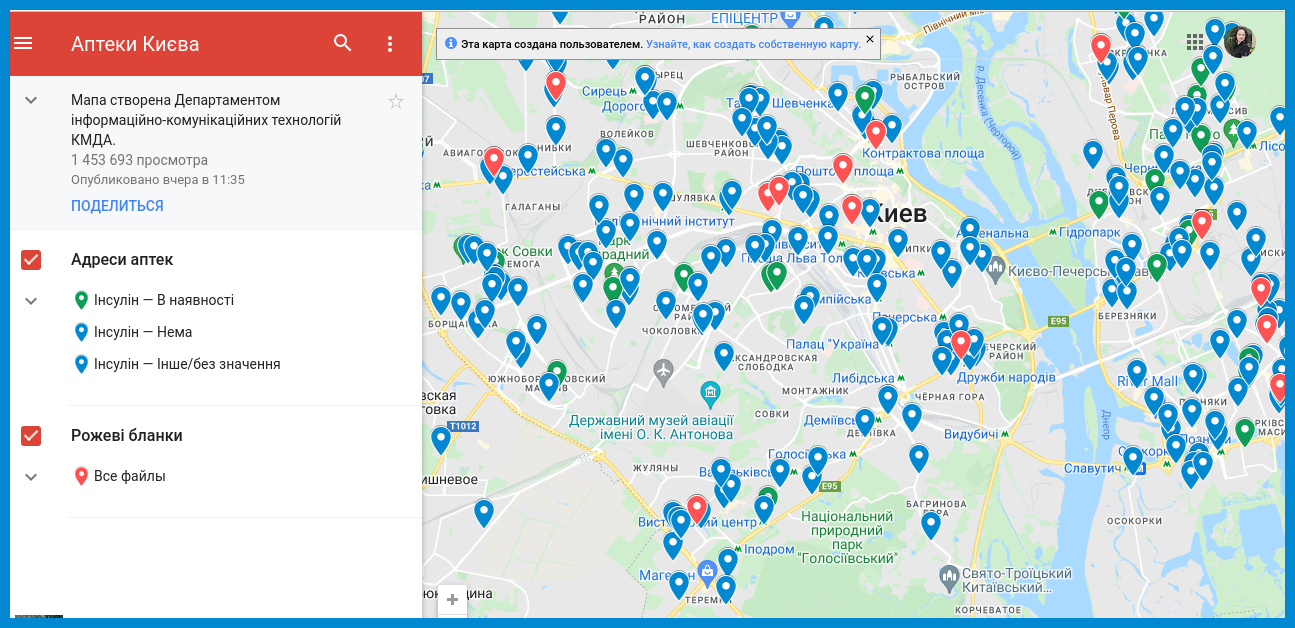

The Department of Information and Communication Technologies of the KMDA has created a map of pharmacies operating in Kyiv on Google Maps. By the way, this option is available to all users, so you can also participate in the creation of maps that relate to important locations in the capital (markets, ATMs, drinking water, etc.).

Business support in 2022 works not only within the framework of all-Ukrainian state and private programs. There are also regional and city initiatives, which every entrepreneur can find out about on the website of his regional state administration, regional council or city council.

Let's hold on!

If you have your own initiative to support business or know of useful opportunities for entrepreneurs, write to bogdana@cityhost.ua so that we can share this information by adding it to the article.